Last summer, on July 8, 2013, President Obama reported on how well his initiative to use technology, and specifically, information technology, to improve the performance of federal government agencies was coming along.

Let’s flash forward to May 28, 2014, nearly a year later, to a little noticed GAO report that documents how effectively the federal government is going about achieving the President’s goals. Jim Ryan of Flexera Software gets straight to the bottom line:

A new US Government Accountability Office (GAO) report has found waste in software spending widespread across the federal government due to lack of coherent and proactive software license management policies. Based on common inefficiencies we see in the private sector, we estimate that the US government wastes up to $2 billion per year, or 25 percent of its annual $8 billion software budget, on shelfware (unused software), under-utilized software, and non-optimized management of software licenses.

Strikingly, Ryan notes an element that’s common to every single scandal that has piled up on the Obama administration’s doorstep in recent years (emphasis ours):

The GAO report found that the vast majority of federal government agencies do not have adequate policies for managing software licenses, due in large part to lack of leadership and direction from OMB – whose core mission is to serve the President of the United States in implementing his vision across the Executive branch.

The current Administration has prioritized eliminating wasteful use of IT resources in its November 9, 2011, Executive Order 13589 promoting efficient agency spending, which states in part that, “Agencies should assess current device inventories and usage, and establish controls, to ensure that they are not paying for unused or underutilized IT equipment, installed software, or services.” Paradoxically, despite its mission to support the President’s vision, report commentary stated that the OMB disagreed with the GAOs findings and had “no plans to develop federal guidance on software license management.”

In short, the Obama administration denies its lack of effective leadership and management of the federal government is a problem and has no plans to resolve the issue. Even if it means that 25% of the federal government’s budget for information technology is being needlessly wasted.

As we recently noted, the Veterans Administration has been cooking the books and falsifying information about wait times. According to CNN, at least 40 veterans died while awaiting treatment at the VA facility in Phoenix. President Obama says he’s angry over the situation but he has not fired VA boss Eric Shinseki. Now, as Jacob Siegel writes in the Daily Beast, it emerges that the dysfunctional, unaccountable VA “may actually have given rewards to those who treated veterans the worst.”

As we recently noted, the Veterans Administration has been cooking the books and falsifying information about wait times. According to CNN, at least 40 veterans died while awaiting treatment at the VA facility in Phoenix. President Obama says he’s angry over the situation but he has not fired VA boss Eric Shinseki. Now, as Jacob Siegel writes in the Daily Beast, it emerges that the dysfunctional, unaccountable VA “may actually have given rewards to those who treated veterans the worst.”

For example, Sharon Helman, the former VA director in Phoenix, the first VA facility accused of keeping a secret waiting list, received more than $9,000 in bonus pay in 2013. Incoming director Steven Young bagged bonuses of $10,000 in 2012 and more than $15,000 in 2010. It remains unclear whether the bonuses were “tied directly to wait times” but Siegel notes that VA bosses got the bonuses despite “repeated calls to ban them” from various representatives, including Jeff Miller, chairman of the House Veterans Committee. The VA facility in Cheyenne, Wyoming, has been the subject of two reports of falsified record that hid delays. Cynthia McCormack, VA director in Cheyenne, bagged more than $11,000 in bonus pay in 2012.

What we have here is institutionalized waste, fraud and abuse of veterans and taxpayers alike. The president’s 2015 budget for the VA is $163.9 billion, an increase of $2 billion over 2014. The bigger budget will supposedly “help ensure that veterans, their families, and survivors receive the highest quality benefits and services we can provide and which they earned through their sacrifice and service to our nation.” It’s not exactly working out that way, and the problems are not new.

In Failure to Provide: Healthcare at the Veterans Administration, Ronald Hamowy explained that because the VA is a government organization, its standard of care will always lag behind that of independent institutions. As the VA budget and payroll expanded, inefficiency and negligence continued to mount. Taxpayers could ask for no clearer demonstration of government monopoly health care, the system the ruling class really wants. One might call it OVAmacare, and the delays, inefficiency and secrecy are all inherent in the system.

Some excerpts from the Office of the Inspector General’s report on the Department of Veterans Affairs’ bureaucrat-led fraud of the real conditions at Phoenix’s VA hospital and a number of other VA facilities, the first of many we will be hearing in the news. We’ll present the results in a Q&A style format:

Some excerpts from the Office of the Inspector General’s report on the Department of Veterans Affairs’ bureaucrat-led fraud of the real conditions at Phoenix’s VA hospital and a number of other VA facilities, the first of many we will be hearing in the news. We’ll present the results in a Q&A style format:

How many veterans are on the official wait list at the Phoenix VA, and how many seeking care have not been added to it?

To date, our work has substantiated serious conditions at the Phoenix HCS [Health Care System]. We identifed about 1,400 veterans who did not have a primary care appointment but were appropropriately included on the Phoenxi HCS’ EWLs [Electronic Wait Lists]. However, we identified an additional 1,700 veterans who were waiting for a primary care appointment but were not on the EWL. Untils that happens, the reported wait time for these veterans has not started. More importantly, these veterans were and continue to be at risk of being forgotten or lost in Phoenix HCS’s convoluted scheduling process. As a result, these veterans may never obtain a requested or required clinical appointment.

How long does the Phoenix VA hospital say in official reports it takes a veteran to get a primary care appointment at that facility, and how long does it really take (based on a statistical sample of veterans)?

VA national data, which was reported by Phoenix HCS, showed these 226 veterans waited on average 24 days for their first primary care appointment and only 43 percent waited more than 14 days. Howevere, our review showed these 226 veterans waited on average 115 days for their first primary care appointment with approximately 84 percent waiting more than 14 days.

How did the VA’s administrators manipulate the official wait list for medical care to hide the long waits for veterans seeking medical treatment?

Scheduling Scheme #1: Schedulers go into the scheduling program, find an open appointment, ask the veteran if that appointment would be acceptable, back out of the scheduling program, and enter the open appointment date as the veteran’s desired date of care. This makes the wait time of an established patient 0 days.

Scheduling Scheme #2: Schedulers at several locations described a process using the Clinic Appointment Availability Report (or similar report) to identify individual schedulers whose appointments exceeded the 14-day goal. Scheduling supervisors told schedulers to review these reports and “fix” any appointments greater than 14 days. Schedulers say they were instructed to reschedule the appointments for less than 14 days. At one location, a scheduler told us each supervisor was provided a list of schedulers who exceeded the 14-day goal. To keep their names off the supervisor’s list, schedulers automatically changed the desired date to the next available appointment, thereby, showing no wait time.

Scheduling Scheme #3: Staff at two VA medical facilities deleted consults without full consideration of impact to patients. The first facility deleted pending consults in excess of 90 days without adequate reviews by clinical staff. Schedulers working at the second facility cancelled provider consults without review by clinical staff.

Scheduling Scheme #4: Multiple schedulers described to us a process they use that essentially “overwrites” appointments to reduce the reported waiting times. Schedulers make a new appointment on top of an existing appointment of the same date and time. This cancels the existing appointment but does not record a cancelled appointment. This action allows the scheduler to overwrite the prior Desired Date and appointment Create Date with a new Desired Date. This adjusts the Create Date to the current date of entry and the Desired Date to the date of the appointment, thus reducing the reported wait time.

What benefits did the VA’s administrators receive for adopting these fraudulent schemes?

A direct consequence of not appropriately placing veterans on EWLs is that the Phoenix HCS leadership significantly understated the time new patients waited for their primary care appointment in their FY 2013 performance appraisal accomplishments, which is one of the factors considered for awards and salary increases.

How else did the VA’s administrators enforce these schemes?

At one location, a scheduler told us each supervisor was provided a list of schedulers who exceeded the 14-day goal. To keep their names off the supervisor’s list, schedulers automatically changed the desired date to the next available appointment, thereby, showing no wait time.

Such are the carrot and stick incentives of bureaucrats who always put their own interests ahead of those of regular Americans.

Jon Ortiz of the Sacramento Bee has dubbed the State Board of Equalization (BOE) headquarters in the state capitol as a “Terror Tower,” with good reason. Since the 24-story office building opened 21 years ago, taxpayers have “shoveled about $60 million into combating defects that have plagued the tower, including invasive mold, leaking windows, burst pipes, unreliable elevators, falling glass and traces of toxic substances.” The cost to fix everything is another $30 million and it would be very costly to move around some 2,000 employees during repairs. In 2007, the state bought the building from CalPERS for $80.7 million and the debt, currently $77 million, won’t be paid off until 2021.

Jon Ortiz of the Sacramento Bee has dubbed the State Board of Equalization (BOE) headquarters in the state capitol as a “Terror Tower,” with good reason. Since the 24-story office building opened 21 years ago, taxpayers have “shoveled about $60 million into combating defects that have plagued the tower, including invasive mold, leaking windows, burst pipes, unreliable elevators, falling glass and traces of toxic substances.” The cost to fix everything is another $30 million and it would be very costly to move around some 2,000 employees during repairs. In 2007, the state bought the building from CalPERS for $80.7 million and the debt, currently $77 million, won’t be paid off until 2021.

What about a lawsuit against contractors and sub-contractors for obviously defective work? As Ortiz notes, “the state’s statute of limitations for defective construction is four years or 10 years, depending on the type of defect” and “the BOE headquarters’ litigation clock ran out in 2002.” So somebody was looking the other way. Assemblyman Roger Dickinson wants a new facility that would cost an estimated $500 million, plus the cost of paying of the debt on the Terror Tower. So in typical government style the money pit gets deeper, all for a bloated bureaucracy of dubious utility.

The Board of Equalization dates from 1879 and its mandate was to ensure that property tax assessments were uniform across all California counties. The BOE no longer “equalizes” anything but collects a variety of taxes and fees. As an elected body the BOE provides a comfy landing spot for termed-out politicians. They represent government to the public and create new ways to shake down taxpayers.

In 1996 the BOE attempted to tax editorial cartoons as though they were works of art purchased in an art gallery. The proposed “laugh tax” made California a national joke, so no surprise that even the board’s headquarters is a disaster. On the other hand, the BOE confirms that government waste, fraud and abuse are always worse than you think.

Taxpayers calculating the cost of government should remain on full alert for waste on all fronts, but particularly in the military. Consider, for example, this story in the Daily Beast about the new fleet of presidential helicopters.

Taxpayers calculating the cost of government should remain on full alert for waste on all fronts, but particularly in the military. Consider, for example, this story in the Daily Beast about the new fleet of presidential helicopters.

These will be “the most expensive helicopters ever made,” with each one logging in at $400 million, rivaling the cost of Air Force One, the president’s Boeing 747. The entire fleet of at least 23 helicopters – the president always flies with decoys – will cost between $10 billion and $17 billion. At the higher figure, which is likely, this project alone “could pay the combined defense budgets of Finland, Norway, and Sweden for one year.”

The push for new presidential helicopters began a decade ago and the initial cost was $6.5 billion, a mere $232 million per helicopter. This program “spun rapidly out of control” but easily consumed $3 billion before cancellation in 2009. Now the Pentagon is paying Sikorsky an initial $1.24 billion for the new fleet.

President Obama told reporters that “the helicopter I have seems perfectly adequate to me,” but the president added: “Of course, I’ve never had a helicopter before. Maybe I’ve been deprived and I didn’t know it.” He won’t get the chance to find out because the new fleet will not be operational until 2022. Eager spenders have long hailed the new presidential helicopters as a “good idea,” but even some hawks think otherwise. Sen. John McCain told reporters, “I don’t think there’s any more graphic demonstration of how good ideas have cost taxpayers an enormous amount of money.” Even so, it is hardly the only example of military waste.

As we noted in Tanks for the Memories and Tanks A Lot, the M1 Abrams tank is a formidable machine but unsuitable for the asymmetrical warfare more common in today’s world. The military has plenty of M1s and doesn’t want any new ones. But politicians still push for more tanks, and now they want to spend $17 billion on a new fleet of presidential helicopters. This confirms that, with the federal government, waste has wings and quickly flies out of control.

The trust fund in question is Social Security’s Disability Insurance (SSDI) trust fund, which is set to be fully depleted sometime in 2016. Brianna Ehley of the Fiscal Times has the details on the fund that provides up to 20% of the money paid to recipients of Social Security disability benefits:

The trust fund in question is Social Security’s Disability Insurance (SSDI) trust fund, which is set to be fully depleted sometime in 2016. Brianna Ehley of the Fiscal Times has the details on the fund that provides up to 20% of the money paid to recipients of Social Security disability benefits:

According to the Social Security Administration, spending on the program has more than tripled since 1983 from $43 billion to $139 billion, adjusted for inflation. It now accounts for about 20 percent of the Social Security Administration’s total budget.

Spending has ticked up so fast in recent years that revenue can’t keep up. The government has paid out more than it has taken in every year since 2009, according to the Social Security Board of Trustees.

If the pattern continues and the program runs out of money by 2016, the millions of Americans collecting disability will see their benefits cut by at least 20 percent.

There are two ways that this situation might be avoided without reducing disability benefits, and also assuming that disability benefits aren’t expanded beyond their currently projected levels:

That second option would mean that Social Security’s other, more well-known trust fund, the Old Age and Survivor’s Insurance trust fund, would itself run out of money much sooner, as there is no other trust fund that the U.S. government might tap to make up those shortfalls in benefit payments.

At present, if this money is not tapped to cover the cost of providing disability benefits, that fund will last until 2033, at which time Social Security’s retirement benefits would need to be cut by at least 23%. Avoiding that situation would require that Social Security payroll taxes be increased by at least 2.4%.

Today, Social Security payroll taxes are equal to 12.4% of an individual’s income, with half of those taxes being paid by U.S. employers. Unless the growth rate and eligibility for its retirement and disability benefits are reigned in, making Social Security’s trust funds solvent enough to provide Social Security benefits at their expected rate of escalation would require those taxes to be permanently increased to 15.1%.

At that rate, there would most certainly be some unintended consequences that would further damage the U.S. economy while never delivering true solvency. And so, it would become necessary to hike those payroll tax rates even more.

Alternatively, the federal government could take steps to restrict eligibility requirements for these social welfare programs and reduce their spending growth rates, which would actually be pretty painless if competently executed.

Which of course explains why no U.S. politician or government bureaucrat has even considered it.

According to the official government website, “The President’s vision for the Department of Veterans Affairs (VA) is to transform VA into a 21st Century organization that is Veteran-centric, results-driven, and forward-looking.” So no surprise that “the President’s 2015 Budget includes $163.9 billion for VA in 2015. This includes $68.3 billion in discretionary resources and $95.6 billion in mandatory funding,” and this “represents an increase of $2.0 billion, or 3.0 percent, over the 2014 enacted level.” This bigger budget “provides the resources necessary to meet its priority goals to increase Veteran access to benefits and services, eliminate the disability claims backlog, and end Veteran homelessness.” The $163 billion budget will also “help ensure that Veterans, their families, and survivors receive the highest quality benefits and services we can provide and which they earned through their sacrifice and service to our Nation.” Sounds good, but how are all those billions working out for the veterans?

According to the official government website, “The President’s vision for the Department of Veterans Affairs (VA) is to transform VA into a 21st Century organization that is Veteran-centric, results-driven, and forward-looking.” So no surprise that “the President’s 2015 Budget includes $163.9 billion for VA in 2015. This includes $68.3 billion in discretionary resources and $95.6 billion in mandatory funding,” and this “represents an increase of $2.0 billion, or 3.0 percent, over the 2014 enacted level.” This bigger budget “provides the resources necessary to meet its priority goals to increase Veteran access to benefits and services, eliminate the disability claims backlog, and end Veteran homelessness.” The $163 billion budget will also “help ensure that Veterans, their families, and survivors receive the highest quality benefits and services we can provide and which they earned through their sacrifice and service to our Nation.” Sounds good, but how are all those billions working out for the veterans?

According to this CNN report, VA bosses have maintained a “secret waiting list” that forced 1,400 to 1,600 veterans “to wait months to see a doctor.” Further, “at least 40 American veterans died in Phoenix while waiting for care at the VA there, many of whom were placed on the secret list.” Similar revelations are emerging “from other VA hospitals across the country,” but that did not force the resignation of Secretary of Veterans Affairs Eric Shinseki. The one to step down was Dr. Robert Petzel, VA undersecretary for health, and the good doctor was going to resign this year anyway. In addition to 40 dead, and allegations of VA bosses cooking the books and falsifying records, the federal Attorney General is not looking to bring any criminal charges. On the other hand, for all but the willfully blind the VA scandal serves up valuable lessons in government monopoly health care, what politicians like to call “socialized medicine” or “single payer.”

Government monopoly health care promotes colossal waste, facilitates incompetence, and remains utterly indifferent to the welfare of its intended beneficiaries. Remember, this system is for veterans, those who, as the VA says, have sacrificed and served for the nation. If government monopoly health care fails veterans so badly, ordinary citizens should expect much worse. Obamacare aside, government monopoly health care is what the ruling class really wants. In the VA, to paraphrase Lincoln Steffens, taxpayers have seen the future and it irks.

As Josh Hicks reports in the Washington Post, the U.S. Postal Service lost $1.9 billion in the second quarter, and the losses come despite increases in revenues, higher prices for stamps, and a boost in USPS package shipping. The losses, Hicks notes, mark “the 20th time in the last 22 quarters in which the USPS has sustained a loss” and the USPS has not shown a profit since 2006. The overall situation is much worse.

As Josh Hicks reports in the Washington Post, the U.S. Postal Service lost $1.9 billion in the second quarter, and the losses come despite increases in revenues, higher prices for stamps, and a boost in USPS package shipping. The losses, Hicks notes, mark “the 20th time in the last 22 quarters in which the USPS has sustained a loss” and the USPS has not shown a profit since 2006. The overall situation is much worse.

For the last three years the USPS has defaulted on an annual $5.7 billion in retiree health benefits and is on track to default again this year. Postal union boss Fredric Roland wants to eliminate the congressional mandate to prefund the benefits, but Joseph Corbett, chief financial officer of the USPS, told reporters that such a move would not balance the books. “Our liabilities exceed our assets by $42 billion,” Corbett told reporters, “and we have a need for more than $10 billion to invest in new delivery vehicles, package sortation equipment and other deferred investments.”

Congress has been unable to trim USPS services such as Saturday delivery. Senators Tom Carper and Tom Coburn are working on a bill to overhaul the USPS, phase out Saturday delivery, and even some to-the-door delivery. Carper contends that the plan would “make the changes that the Postal Service needs to thrive into the future.” Based on its record, taxpayers have good reason to doubt whether the USPS will ever “thrive.” That is because legislators decline to make the most important change the Postal Service needs.

Legislators should lift the USPS monopoly on first-class mail and let the USPS compete with UPS, FedEx and other companies on that front, just as it now does in package shipping. Only competition in an open market can spur the reforms the USPS needs. Otherwise the federal government will continue to abuse taxpayers, and common sense, by keeping this born loser afloat.

Not long ago, we looked at the situation where politicians and bureaucrats use their authority to regulate economic activity to impose costs on regular Americans. In doing that, we noted the role of the “corporate cronies”, who use push for government regulation as a means to put their market competitors at a disadvantage so they can juice their profits, with a portion going into the pockets of their “public servant” benefactors, which they use to advance their own political and personal interests.

We concluded that was “how ‘public servants’ get rich.

Today, we stand corrected, because it turns out that is just one way that public servants can get rich. In truth, most bureaucrats can effectively become millionaires through their extremely generous and taxpayer-guaranteed public employee pension schemes, which accounts for the largest portion of the outsized compensation of public employees compared to their peers in the private sector.

The reason we stand corrected is because of the math that Forbes‘ Rich Karlgaard did to find out what the effective net present value of the retirement nest egg of a simple California state police officer would have to be to provide them with an annual income of $80,000 for the rest of their lives after they retire at Age 55 in The Millionaire Cop Next Door:

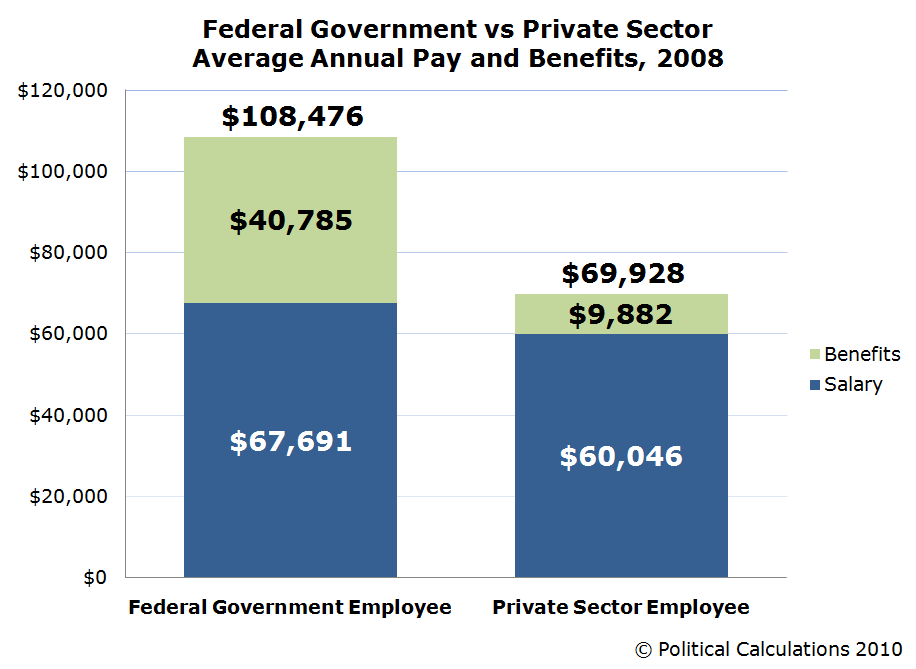

It’s said that government workers now make, on average, 30% more than private-sector workers. Put that fantasy aside. It far underestimates the real figures. By my calculations government workers make more than twice as much. They are America’s fastest-growing group of millionaires.

Doubt it? Then ask yourself: What is the net present value of an $80,000 annual pension payout with additional full health benefits? Working backward the total NPV would depend on expected returns of a basket of safe investments–blue-chip stocks, dividends and U.S. Treasury bonds.

Investment pros such as my friend Barry Glassman of Glassman Wealth Services say 4% is a good, safe return today. But that’s a pitiful yield, isn’t it? It’s sure to disappoint the millions of baby boomers who will soon enter retirement with nothing more than their desiccated 401(k)s–down 30% on average from 30 months ago–and a bit of Social Security.

Based on this small but unfortunately realistic 4% return, an $80,000 annual pension payout implies a rather large pot of money behind it–$2 million, to be precise. That’s a lot. One might guess that a $2 million stash would be in the 95th percentile for the 77 million baby boomers who will soon face retirement.

That $2 million also happens to be the implied booty of your average California policeman who retires at age 55.

Really, the only fault we can find with the analysis is that it suggests that cops in California wait until they reach Age 55 to retire with that kind of taxpayer-funded pension benefit. In reality, the average retirement age for police officers in California is somewhere between Age 53 and 55, depending upon whether they work at the state or local level:

The problem with providing such extremely generous pension benefits to public employees is that nobody can afford to pay them, which means that the demand of public servants to receive such generous pension payouts is creating a looming pension disaster:

For years, the state’s coastal cities and inland municipalities have promised — and delivered — larger and larger retirement benefits to public sector workers. Now, California state and local governments face an estimated $655 billion in unfunded pension and health care liabilities.

A new database available at www.transparentcalifornia.com contains salary and pension data for most of California’s government employees. It paints a startling picture of state profligacy. In 2012, over 99,000 California county employees received six-figure salary compensation packages, representing over 50 percent of the estimated full-time workforce, while over 12,000 county workers made in excess of $200,000.

The problem is acute in the Bay Area, where public employee compensation has reached unsustainable highs. Pensions in Alameda County provide 538 retirees with payouts of over $100,000 a year — 25 of which enjoy packages exceeding $200,000 in annual income. Alameda’s retired public defender clears over twice that sum — $527,255 a year. One retired Palo Alto official clears $281,108; a Mountain View retiree, $262,365. From Sunnyvale to Berkeley to San Leandro and beyond, the list goes on and on.

The fiscal irresponsibility doesn’t stop with pensions. The highest-paid public employees enjoy salaries that most taxpayers could only dream of. Hayward’s Deputy Fire Chief pulled down $328,000 in total compensation. A Milpitas fire chief took home $494,000. And in Santa Clara, the acting police chief made out like a bandit with a grand yearly total of $639,000.

Who will protect the interests of the public from the public servants?

Most Americans have completed their tax returns and may even have got back some of their own money. Now they should get out the government cost calculator again because as Kelly Cohen reports in the Washington Examiner, last year the IRS gave out between $13.3 billion and $15.6 billion in improper payments. That amounted to nearly one fourth of all payments under the Earned Income Tax Credit (EITC) and it was the third year in a row the IRS failed to reduce the improper payments. As Cohen noted, the IRS has also failed to provide all required information for the Improper Payments Elimination and Recovery Act of 2010. And this is hardly the extent of IRS failure.

Most Americans have completed their tax returns and may even have got back some of their own money. Now they should get out the government cost calculator again because as Kelly Cohen reports in the Washington Examiner, last year the IRS gave out between $13.3 billion and $15.6 billion in improper payments. That amounted to nearly one fourth of all payments under the Earned Income Tax Credit (EITC) and it was the third year in a row the IRS failed to reduce the improper payments. As Cohen noted, the IRS has also failed to provide all required information for the Improper Payments Elimination and Recovery Act of 2010. And this is hardly the extent of IRS failure.

Between October 1, 2010 and December 31, 2012 the IRS gave more than $2.8 million in bonuses to 2,800 employees with disciplinary issues and tax compliance problems of their own. As Gail Sullivan observed in the Washington Post, “the IRS’s contract with the National Treasury Employees Union bars the agency from considering bad conduct when making performance-based awards.” So IRS bosses were just following the rules when they rewarded bad employees and tax deadbeats.

The IRS has also been singling out groups for extra scrutiny based on their political views and calling it “horrible customer service.” In 2012 the IRS sent out more than $3 billion in fraudulent tax refunds to people using stolen identities. A full 655 fraudulent refunds went to a single address in Lithuania and 343 to one address in Shanghai. As the president might have put it, if you like your fraudulent refund you can keep it, period.

The EITC program, meanwhile, is the only one tagged “high risk,” by the Office of Management and Budget. The IRS says it is working to fix the problem but taxpayers should remain skeptical because the agency has not managed to reverse other failures. On the other hand, the IRS may be the best evidence that the federal government has institutionalized waste, fraud and abuse.

| S | M | T | W | T | F | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | ||||||